Medicare will cover specific in-home dementia care services when you meet certain eligibility requirements. You’ll need a doctor’s certification confirming you’re homebound and require skilled nursing or therapy services. Coverage includes skilled nursing visits, physical therapy, occupational therapy, and some home health aide care through Medicare-certified agencies. Medicare Advantage plans may offer additional benefits like specialized dementia support and caregiver training. Understanding the full scope of available benefits can help maximize your coverage options.

Medicare Coverage Basics for Dementia Care

While Medicare doesn’t cover all dementia care services, it does provide important coverage options through its different parts.

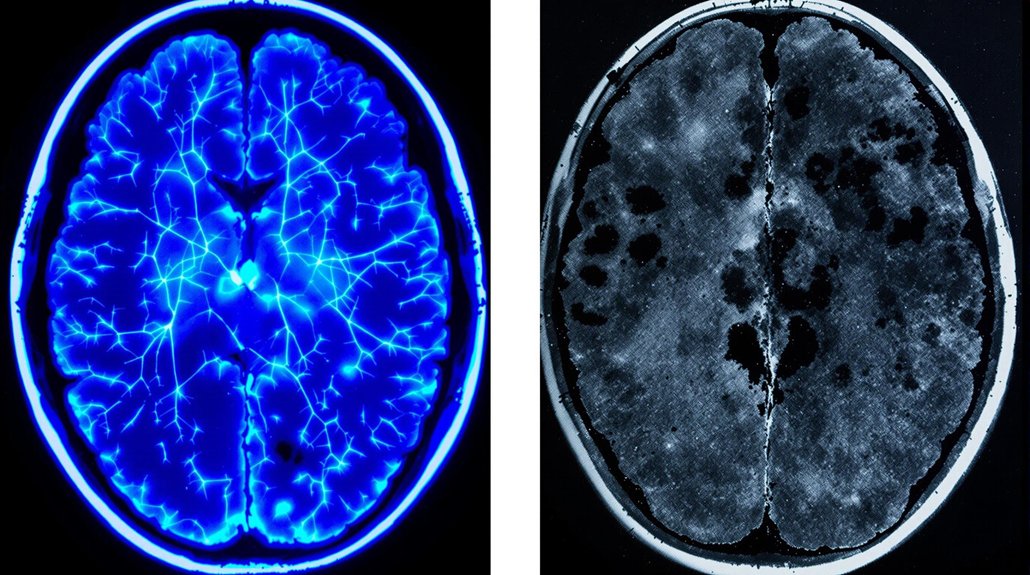

Medicare Part B covers medical visits for dementia diagnosis and ongoing care planning with your healthcare providers. You’ll receive coverage for lab tests, cognitive assessments, and necessary diagnostic imaging.

Regular check-ups, tests, and assessments for dementia diagnosis are covered under Medicare Part B, helping patients get comprehensive care.

Part A helps with inpatient hospital stays and skilled nursing facility care when needed for dementia-related conditions.

Part D assists with prescription medications that help manage dementia symptoms and related behavioral issues. If you’ve chosen Medicare Advantage (Part C), you might’ve access to additional benefits beyond Original Medicare, including some home health services.

Understanding these coverage elements helps you better serve your loved one’s needs while managing healthcare costs effectively.

Respite care services can provide temporary relief for family caregivers who need a break from the demanding responsibilities of dementia care.

Types of In-Home Care Services Medicare Covers

Medicare’s coverage of in-home care focuses on specific medical services that meet strict eligibility requirements. If you qualify, you’ll receive coverage for skilled nursing visits, physical therapy, occupational therapy, and speech therapy. Your coverage also includes medical social services and part-time home health aide care.

While Medicare doesn’t directly pay for home modifications or full-time caregiver support, you may receive coverage for durable medical equipment like hospital beds, wheelchairs, and oxygen supplies.

Medicare will also cover brief training sessions to help family caregivers learn essential skills for managing dementia care at home. These sessions typically include instruction on medication management, safety procedures, and basic nursing tasks.

Long-term care insurance and Medicaid may provide additional coverage options for comprehensive Alzheimer’s home care services.

Remember that all services must be ordered by your doctor and provided through Medicare-certified home health agencies.

Eligibility Requirements for In-Home Dementia Care

To qualify for Medicare’s in-home dementia care coverage, you must meet several key requirements. You’ll need certification from your doctor that you’re homebound and require skilled nursing care or therapy. In-home assessments by Medicare-approved providers will determine your specific needs.

| Requirement | Original Medicare | Medicare Advantage |

|---|---|---|

| Doctor Certification | Required | Required |

| Homebound Status | Must be verified | Must be verified |

| Skilled Need | Nursing or therapy | Nursing or therapy |

| Care Plan | Must be documented | Must be documented |

Your doctor must regularly review and certify your care plan. You’ll also need to work with Medicare-certified home health agencies that provide caregiver training and support. Remember that your cognitive impairment from dementia alone doesn’t qualify you – you must need skilled care services that only licensed medical professionals can provide. Professional medical services are tailored to individual needs through comprehensive care assessments to enhance quality of life at home.

Medicare Part A and B Benefits for Home Care

Both Original Medicare Parts A and B offer distinct coverage options for in-home dementia care, depending on your specific health needs.

Under Part A, you’ll receive coverage for intermittent home care if you’re homebound and need skilled nursing care after a qualifying hospital stay of at least three days. This includes services like physical therapy and medical social services.

Medicare Part B helps cover your medical supplies, durable medical equipment, and certain outpatient home care services when they’re medically necessary.

You’ll have access to dementia services such as occupational therapy, speech therapy, and mental health counseling. Part B also covers your doctor’s visits to develop and review your care plan.

Remember that you’ll need to use Medicare-certified home health agencies to receive these benefits.

Families can also access specialized dementia care services through private providers that offer comprehensive memory care solutions and personalized support.

Understanding Medicare Advantage Plans for Dementia

While Original Medicare provides essential coverage, Medicare Advantage plans (Part C) often include additional benefits for dementia care that can help fill important gaps in coverage.

These plans may offer specialized dementia support services like adult day care, respite care, and personal care assistance that aren’t covered under traditional Medicare benefits.

Medicare Advantage plans can provide vital dementia support services beyond traditional Medicare, including adult day care and personal assistance options.

You’ll find that many Medicare Advantage plans include extra services tailored to dementia patients, such as transportation to medical appointments, meal delivery, and home safety modifications.

Some plans even provide caregiver training programs and access to memory care specialists.

When choosing a plan, it’s important to compare different providers’ offerings and guarantee the specific dementia support services you need are included in the coverage.

Contact individual insurance providers to learn about their specific dementia care benefits.

Long-term care insurance policies may provide additional coverage options when Medicare benefits are insufficient for comprehensive dementia care needs.

Cost-Sharing and Out-of-Pocket Expenses

Understanding Medicare’s cost-sharing requirements is essential for families managing in-home dementia care.

You’ll need to conduct a thorough cost analysis to prepare for expenses not covered by Original Medicare or Medicare Advantage plans. These may include copayments, deductibles, and coinsurance for approved services.

Your expense management strategy should account for both covered and non-covered services. While Medicare might pay for medically necessary home health care, you’re responsible for costs like personal care assistance, meal preparation, and round-the-clock supervision.

Consider setting aside funds for supplemental care, as Medicare typically won’t cover extended custodial care. You’ll also want to track out-of-pocket expenses carefully, as they can quickly accumulate.

Many families find it helpful to work with a financial advisor who specializes in healthcare planning.

Alternative Funding Sources for Home Care

Beyond Medicare’s coverage limitations, several alternative funding sources can help offset the costs of in-home dementia care.

You’ll want to explore multiple options to create a thorough funding strategy for your loved one’s care needs.

Consider these key funding sources to help manage care expenses:

- Personal savings and retirement accounts can provide immediate access to funds, though you’ll need to carefully balance using these assets against future needs.

- Long-term care insurance policies specifically designed for home care services often cover professional caregivers and support services.

- Veterans benefits, Medicaid waivers, and reverse mortgages may offer additional financial support depending on your situation.

Each funding source has unique qualification requirements and benefits, so you’ll want to consult with a financial advisor to determine the best combination for your family’s circumstances.

Working With Medicare-Certified Home Health Agencies

When selecting a home health agency for dementia care, you’ll want to verify their Medicare certification status to confirm coverage eligibility and quality standards.

Look for agencies that specialize in dementia care and maintain strong care coordination practices with medical providers and specialists.

Professional dementia care requires specialized expertise and seamless coordination between home health agencies and healthcare providers.

To confirm an agency’s Medicare certification, check the Medicare.gov website or contact your local Medicare office. Medicare-certified agencies must meet strict federal requirements for patient care, staff qualifications, and documentation.

They’ll work directly with your loved one’s doctor to develop and adjust care plans as needed.

Remember that certified agencies can provide skilled nursing, therapy services, and medical social work under Medicare coverage.

This integration of services guarantees your family member receives thorough home health support while maintaining compliance with Medicare guidelines.

Documentation and Medical Necessity Requirements

Medicare coverage for in-home dementia care depends heavily on proper documentation and proof of medical necessity. Your healthcare provider must complete detailed medical documentation and necessity assessments to demonstrate that services are reasonable and required for your condition.

To qualify for coverage, you’ll need:

- A face-to-face evaluation with your doctor within 90 days before or 30 days after starting home health services

- Regular documentation showing your dementia symptoms and how they impact your daily functioning

- Written certification from your doctor confirming you’re homebound and need skilled care

Keep thorough records of all evaluations, treatments, and progress notes.

Your home health agency will work with you to guarantee all required paperwork meets Medicare’s strict documentation standards, helping maintain your essential coverage for dementia care services.

Coordinating Care With Medicare Benefits

Successfully coordinating your dementia care requires understanding how different Medicare benefits work together. You’ll need to carefully manage benefits across multiple providers and services to guarantee all-encompassing care for your loved one with dementia.

| Service Type | Medicare Coverage | Your Role |

|---|---|---|

| Home Health | Part A/B | Coordinate visits with nurses |

| Medical Equipment | Part B | Track equipment needs |

| Prescription Drugs | Part D | Manage medications |

When coordinating care, you’ll want to work closely with your loved one’s primary physician to develop a care plan that maximizes available Medicare benefits. Keep detailed records of all services, and don’t hesitate to contact Medicare’s helpline when you need clarification about coverage. Remember that some services may require pre-authorization, so planning ahead helps guarantee continuous care while managing benefits effectively.

Conclusion

Medicare won’t cover 24/7 dementia care at home, but you have several ways to get help. Think of it like putting together pieces of a puzzle – you can combine Medicare benefits with other resources to create the care your loved one needs. Just as you want to keep your loved one safe while respecting their wishes to stay home, there are options that can help you do both.

You don’t have to figure this out by yourself. Many families face these same challenges, and there are caring professionals ready to help you find the best path forward. Having someone guide you through these choices can make all the difference, just like having a trusted friend by your side.

If you or a loved one need help, don’t wait. Reach out to Focus Family Care today at (561) 693-1311 or email us at info@focusfamilycare.com.